Chinese semiconductor equipment manufacturers usher in a period of development

In the process of "falling", the outside world has a somewhat negative attitude towards the semiconductor market. Many industry prediction agencies have pointed out that the chip industry is about to face a downturn. The chip market in China has shrunk by 1.8% compared with a year ago, while the Asia Pacific region excluding China has only increased by 4.1%. However, in the first half of this year, the utilization rate of many IDM fabs was still much higher than 90%, and that of semiconductor foundries was more than 100%. Orders remained strong during the economic recovery after the epidemic.

SEMI data shows that the global semiconductor equipment market will grow by 7% in the second quarter of 2022. The purchase of the Chinese market in the second quarter was the market with the largest decline from the month on month and year on year data.

According to the financial reports of SMIC International and Huahong Semiconductor, the month on month expenditure on equipment of China's two semiconductor factories declined in the second quarter. To make matters worse, in August, the US government sent a letter to several semiconductor equipment manufacturers requesting that China not export advanced process wafer factory equipment below 14nm.

A skillful woman cannot make bricks without straw. The limited import of manufacturing equipment will inevitably affect the development of China's semiconductor manufacturing industry. As a result, industry professionals have focused on domestic semiconductor equipment companies.

Cold Market and Hot Semiconductor Equipment Market

The importance of semiconductor manufacturing equipment has only increased in the context of developing local manufacturing capacity around the world. In the data released by SEMI, the growth of equipment sales in Taiwan, China, South Korea, North America and Europe also proves this trend.

Previously, the Nikkei Asia Review reported that large semiconductor equipment manufacturers such as Applied Materials, KLA, Lam Research, ASML, etc. warned customers that some key equipment must wait up to 18 months before delivery, because parts such as lenses, pumps, valves, microcontrollers, engineering plastics, and electronic modules are all in short supply. The delivery date of some testing equipment of Kelei has reached more than 20 months.

In the difficulty of shipping, whoever can ship in time is often the winner. Part of the reason why Japanese semiconductor equipment manufacturers can maintain rapid development is due to inventory management. Japanese enterprises tend to hold more inventory in response to unpredictable events such as disasters. With inventory management, the production and shipment of Japanese factories are more smooth.

The growth of semiconductor equipment market reflects the still hot demand for semiconductor capacity. IDM and OEMs are investing heavily in new manufacturing capabilities to manufacture logic and storage devices that use leading process technologies. The strong demand and continuous shortage of many other important chips, such as power semiconductors, analog ICs and various MCUs, led suppliers to improve the manufacturing capacity of these products. All kinds of signs indicate that the boom in the semiconductor equipment market has not ended.

Taiwan, China, China with the largest scale in Q2, has been expanding constantly. In 2022, Q2 semiconductor OEM market achieved double-digit revenue growth. TSMC achieved double-digit growth in wafer shipments. According to media reports, the senior management of TSMC's procurement department has gone to the United States twice to understand the tight supply of equipment, and then sent the supervisor to negotiate with the equipment supplier and place an order with a single digit price increase, hoping to get the equipment as soon as possible.

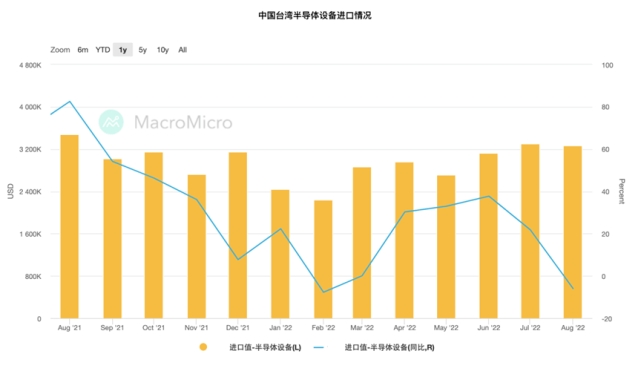

Judging from the year-on-year changes in the import value of semiconductor equipment in Taiwan, China, the import value of equipment in the first two months of the third quarter increased by more than 20% year on year. In September, TSMC's 2nm plant began land preparation. TSMC's normal expansion further proved the determination of semiconductor manufacturing companies in Taiwan, China to strengthen their position in the OEM industry.

Europe has witnessed substantial growth, and there is still room for growth in the future. The EU Chip Act was passed earlier than the US Science and Chip Act, so in the second quarter, Europe attracted some semiconductor companies to build factories. In March this year, Intel announced the establishment of a 17 billion euro factory in Magdeburg; In the same month, Universal Wafer, a silicon wafer manufacturer in Taiwan, China, announced that its Italian subsidiary MEMCSPA would build a new 12 inch wafer production line, which is expected to open capacity in the second half of 2023.

The growth of European semiconductor capacity will continue. On July 14, Italian and French Semiconductor and Lattice officially announced that they would focus on the establishment of a new 12 inch wafer joint venture near the existing French Crolles 12 inch wafer factory of French Semiconductor. The expansion of local capacity has become the driving force for the future development of the European semiconductor equipment market.

In terms of the global market, Bloomberg reported in July that Samsung planned to spend nearly $200 billion to expand 11 wafer factories in Texas, USA. In August, SMIC announced that it planned to invest US $7.5 billion to build a 12 inch foundry in Tianjin. The continuous expansion of the foundry shows that the semiconductor equipment market still has growth potential.

Local semiconductor equipment companies need to grow as quickly as possible

It is easy to understand why the decline of semiconductor market size will accompany the sales growth of local semiconductor equipment companies. Japan is another country where the shipment of semiconductor equipment has declined. Although the shipment of equipment has not increased, the sales of domestic semiconductor equipment in Japan have always performed well.

In the fourth quarter of 2021, the growth rate of Japanese companies, the world's top 9 equipment manufacturers, is the largest. From January to May this year, the sales volume of Japanese semiconductor equipment manufacturers rose by nearly 30%, breaking the record. At the same time, the Japan Semiconductor Manufacturing Equipment Association (SEAJ) released a forecast report that the sales of semiconductor equipment in Japan will exceed 4 trillion yen for the first time from April 2022 to March 2023, a year-on-year increase of 17%, a record high for three consecutive years.

South Korea, whose shipments declined year on year, is also committed to improving the development of local semiconductor equipment. Hanmi Semiconductor, a Korean semiconductor equipment manufacturer, recently disclosed its wafer cutting machine developed and produced by the company, intending to compete with Japanese related companies.

The expansion of domestic wafer plants and the limited import of manufacturing equipment have provided opportunities for domestic semiconductor equipment plants, and equipment and materials are showing an upward trend against the trend. From the perspective of financial statements, the performance of many Chinese semiconductor manufacturing equipment in the first half of the year was better.

Tuojing Technology said that the company's semi annual performance increased significantly thanks to the continuous growth of sales orders of semiconductor film deposition equipment. In the semi annual report of 2022, 2022H1 achieved an operating revenue of 523 million yuan, with a year-on-year growth of 364.87%; The net profit attributable to the parent company was 108 million yuan, and the net profit attributable to the parent company after deducting non profits was 49 million yuan, turning losses into profits over the same period of last year. In Q2, the company achieved revenue of 416 million yuan in a single quarter, up 658% year on year; The net profit attributable to the parent company was 120 million yuan, with a year-on-year increase of 130 million yuan.

North Huachuang released the semi annual report of 2022, in which the financial data showed that the company's net profit in the first half of the year was 755 million yuan, with a year-on-year growth of 143.16%; The operating revenue was 5.444 billion, with a year-on-year growth of 50.87%; The revenue of electronic process equipment was 4.1 billion yuan, up 45% year on year, and the revenue of semiconductor equipment was 3.87 billion yuan, up 55% year on year.

In the first half of 2022, MEC achieved an operating revenue of 1.972 billion yuan, a year-on-year increase of 47.30%; Net profit attributable to the parent company was 468 million yuan, up 17.94% year on year; Non net profit was 441 million yuan, up 615.26% year on year. In the first half of 2022, the amount of newly signed orders increased by 61.83% year on year, reaching 3.057 billion yuan.

However, there are still some problems with domestic semiconductor equipment. SemiAnalysi analysts said that the engineers of SMIC International blew themselves up and there were a lot of problems with China's self-developed DUV exposure machine. At present, no DUV exposure machine with good functions has been manufactured. He said that SMIC engineers themselves disclosed that these home-made machines are easy to be complained about. He also stressed that China's technology of using foreign equipment to make chips is many years behind, and its domestic equipment is decades behind foreign countries. This partly reflects that the domestic equipment is still in the catching up stage.

The development of local semiconductor equipment companies should focus on the joint efforts of upstream and downstream

The growth of local equipment companies depends not only on their own efforts, but also on the cooperation between upstream and downstream industries. Only by learning and developing the industrial chain together, can we quickly establish the strongest competitiveness in this industry. In order to achieve this, a large number of human and material resources are needed to constantly coordinate various resources to support the application and development of the domestic industrial chain. All over the world, in the past, any region with rapid development of semiconductor industry has an excellent industrial chain as a strong backing.

As users of equipment and materials, Chinese local wafer manufacturers represented by SMIC International are actively supporting the application of domestic industrial chain products. Zhao Haijun, the joint CEO of SMIC International, said that since more than 10 years ago, SMIC International has actively promoted the development of the domestic supply chain, including the introduction of the first set of equipment, the first batch of materials, the inspection and evaluation of products, and then the improvement of products with suppliers. Once the products can meet the requirements of mass production, SMIC will quickly introduce mass production to achieve mass production verification.

SMIC hopes to purchase local products that meet the requirements as much as possible, because a more perfect domestic supply chain is a guarantee of safety for local wafer manufacturers. Only by cultivating the local industrial chain can SMIC and other companies in the same industry develop steadily.

Faced with the bottleneck of starting from equipment in the United States, domestic semiconductor equipment companies must grow as soon as possible. Industry insiders also agree that this period of time when the United States is stuck is a window for Chinese semiconductor equipment companies to make up for the basic links. From this perspective, the export restrictions imposed by the United States on Chinese semiconductor equipment will force the growth of Chinese semiconductor equipment companies.

There is no doubt that there is still a long way to go for domestic semiconductor to replace. In the field of semiconductor equipment, it must not be a single enterprise fighting alone, but the coordinated development of industrial clusters. In order to catch up with the international level, China's semiconductor industry needs to go all out to jointly promote the semiconductor industry to reach the international level.

- Previous:

- Next:In this battle field, China's local RF chips compete